Calculating the most efficient pathways to net zero mines

Environmental, social and governance (ESG) issues continue to top the agenda in mining. While there is more to ESG than decarbonisation, the climate changes we are racing against means that this topic is a top priority for miners across the globe.

Future technologies, such as battery-electric vehicles (BEVs) and hydrogen-powered mining trucks, offer huge potential in lowering miners’ direct greenhouse gas (GHG) emissions. However, many are unproven at scale or carry teething issues. While these technologies will play an essential role in mid to long-term decarbonisation strategies, their full benefit will not be realised for some years.

To limit global warming to 1.5 degree Celsius, as outlined in the Paris Agreement, there is an urgent need for affordable solutions that offer near-term GHG reductions. In its 2021 article 'Creating the carbon zero mine', McKinsey & Co explains that, for the first stage of a company’s decarbonisation strategy, focusing on "cost-positive alternatives with technology available today" could lower mine emissions by up to 60% over the next three to five years.

Prioritising efficiency projects

This is where operational efficiency and simulation programmes come into play. At almost every mining operation, there will be areas of low-hanging fruit – inefficiencies, such as bottlenecks or delays in processes and systems – that can be identified and resolved without a major capital investment. Doing so not only produces financial savings through using current equipment more efficiently, but mines will also see ESG benefits in the form of lower resource consumption, fewer emissions and less waste.

Overcoming the perceived risk associated with new technologies and unlocking significant sums of capital for these implementations are major challenges for miners today. Given the need for decarbonisation, it makes sense to focus on efficiency improvements first and technology changes second once there is bandwidth for larger, more costly projects.

Colin Eustace, head of simulation at Polymathian, explains: "Improvements in operational efficiency allow mines to get the same amount, or more, out of a system using less. By analysing their operational data, companies can gain insights about inefficiencies in their systems and decide which changes will help them achieve their objectives most efficiently over different timeframes.

"Mining companies tend to look to new technologies first when addressing sustainability challenges, because they're more tangible," says Eustace. "ESG benefits from data-driven efficiency improvements are more difficult to demonstrate, and that's why they are sometimes overlooked. The best solution for cutting resource consumption or emissions is to use less energy and water in the first place. Waste minimisation requires a holistic understanding of how the system and its components work, individually and collectively, as well as the ability to test different solutions until the optimal one is found."

Making operational choices for ESG gains

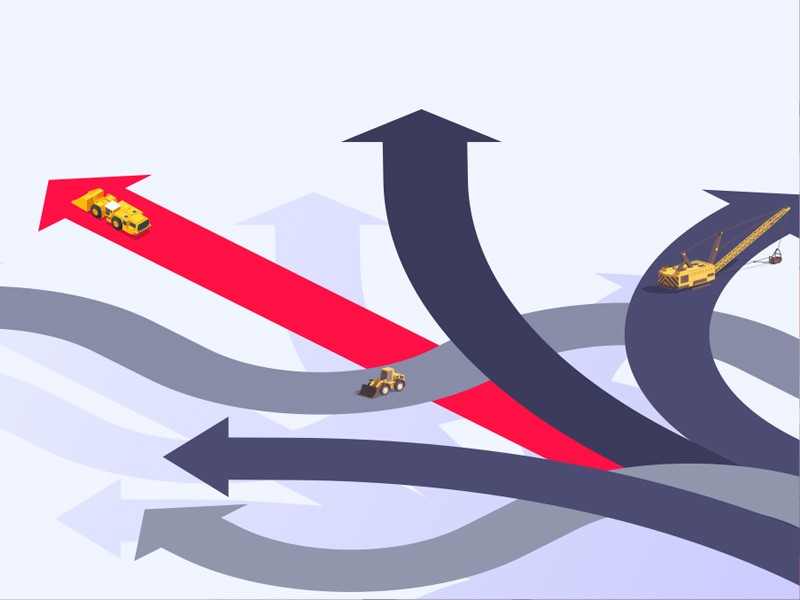

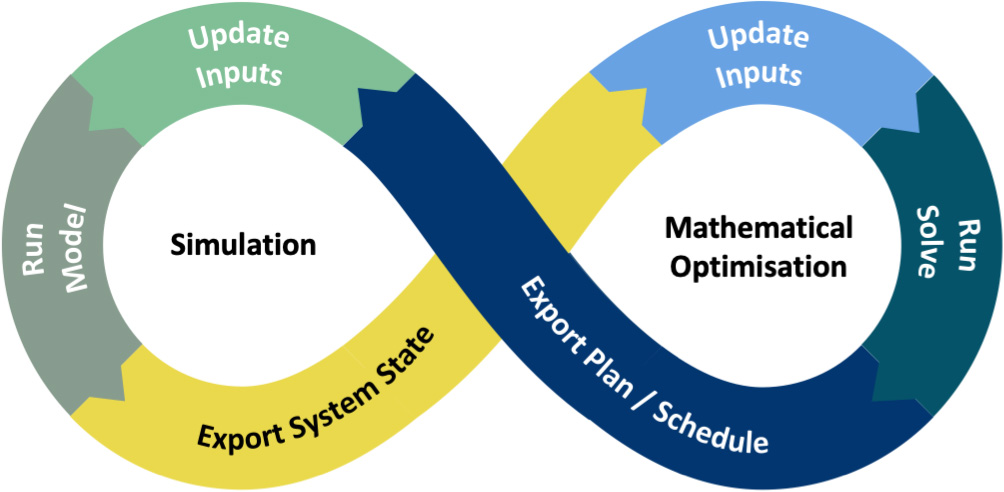

Two main techniques can be used to drive operational efficiencies and assess the impact of technological changes on mines as a complete system. Mathematical optimisation and simulation can solve different aspects of the same problem, and often there's overlap in their applications.

Integrating simulation and optimisation models to provide a more robust solution for clients

Mathematical optimisation prescribes an optimal solution based on business objectives while considering all decision variables and system constraints. All possible outcomes based on the parameters given are examined to identify the best possible solution. For instance, it can be used to blend ore in a way that meets quality requirements while also hitting ESG objectives, such as reductions in vehicle emissions or ambient dust levels.

Eustace continues: "Simulation is applied to evaluate the performance of complex systems and to examine the difference in impact between a smaller set of options. For instance, it can determine whether one operating strategy is more effective than another or look at the performance of different types of equipment – say, trucks or conveyors – in the same system. Both techniques target improving system performance, but choosing which to use depends on the nature of the system and the problem that needs to be solved."

Both optimisation and simulation can be deployed strategically, tactically and operationally to determine which investment, scenario or process will deliver the best net present value (NPV) across different time horizons. This allows leaders to make the best possible operational decisions in support of the company's larger ESG goals.

A good example is a recent project Polymathian undertook for a major global commodity provider. The company wanted to optimise maintenance shutdowns at its iron-ore processing operations. Polymathian was tasked with recommending an optimal strategy that reduced worker-related safety risks while maintaining the plant effectively and maximising throughput.

Using its software and consulting services, Polymathian delivered a strategy that resulted in a better stockpiling profile, improved maintenance conformance, increased throughput and a 40% reduction of workers during peak maintenance periods.

By eliminating unnecessary shutdowns, which are extremely resource-heavy, the client also saw a reduction in scope 1 GHG emissions and scope 3 (those produced indirectly by supply chain operations) by lowering contractor travel and accommodations.

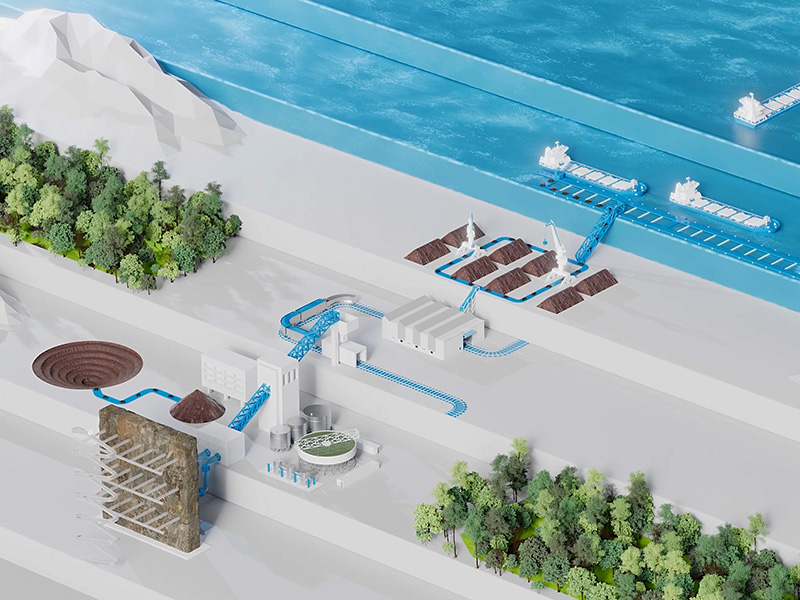

Small improvements in efficiency at the operational level can also add up to big improvements at the enterprise or supply chain level. For example, for miners of bulk commodities such as iron ore or bauxite, scope 3 GHG emissions comprise up to 95% of their total emissions.

Reducing these is a key concern. By analysing the impact of different operational strategies on processes and product movements across multiple businesses, it's possible to make decisions that collectively deliver big impacts. For instance, digital simulation and optimisation tools can reveal opportunities to re-route shipments or optimise rail schedules to lower fuel consumption. They can also assess the impact of replacing fossil fuels with renewable energy options for longer-term gains.

New technologies: what works and what doesn't?

Both optimisation and simulation can also be used to make better decisions surrounding technology changes which support ESG objectives.

"One of the most significant benefits we've seen is identifying where systems may or may not work in certain circumstances," explains Eustace. "A technology switch may appear to work on paper but, in reality, there may be complex interactions in the system that could lead to delays or bottlenecks.

"Often, projects will go through the concept phase based on rule-of-thumb assumptions for efficiency at the interface between two equipment types. But when examined in detail, there can be constraints that mean the interface creates more losses than expected; enough to rule out that method of operation."

Mining operations are usually long-life assets and, particularly with underground operations such as block caves, there can be little tolerance in the system for deviations from the original mine plan. Where ESG targets might drive changes to equipment or operations, simulation is vital in checking that these changes are viable and sustainable for the system as a whole.

Using simulation models to understand mine performance

Polymathian recently teamed up with OZ Minerals to analyse production level operations for the Carrapateena block cave operation in Australia as part of the mine's expansion to 12Mtpa. The findings showed that production levels could be maintained when diesel loaders were replaced with BEVs with modifications to the operating strategy.

Polymathian performed a number of simulations on the base case footprint design, as well as different designs and operating strategies. Alternative equipment combinations (including battery-electric loaders and trucks), fleet sizes and other parameters were varied to find the solution that best met the company's production and decarbonisation targets simultaneously.

The tip of the optimisation iceberg

Although there is a historical tendency in mining to use technologies that promise to solve ESG challenges, the examples discussed here demonstrate significant value that can be found by improving the efficiency of existing equipment, processes and systems.

There is a growing understanding of the value simulation and mathematical optimisation can provide in this context and also in evaluating the impact of step-change technologies on mining operations as a complete system. Over time, as businesses see the benefit of deploying these solutions in local applications and as technologies mature and become more accessible, their use cases will likely be scaled to business and supply chain-wide implementations.

"When we talk about ESG, it's easy to focus on electrification and renewables for improving the way we mine," says Eustace. "But operational efficiency is an important piece of the puzzle, if not more so. To reach net-zero, mines need the right equipment and to work as efficiently as possible."

Learn more about Polymathian's simulation capabilities.Article contributor

Carly Leonida, Freelance technical writer and editor | Owner/author of The Intelligent Miner | European editor at Mining Media Intl

Carly has been writing for and managing some of the industry’s leading trade titles for over a decade. She is now a freelance technical writer and is on a mission to transform how the world views and relates to mining. Connect with Carly on LinkedIn.