Injecting agility into strategic mine planning

Fast changing and less predictable business, operating and economic environments are making long-term mine planning increasingly difficult. But there are tools that underground operators can lean on to stay ahead of the game

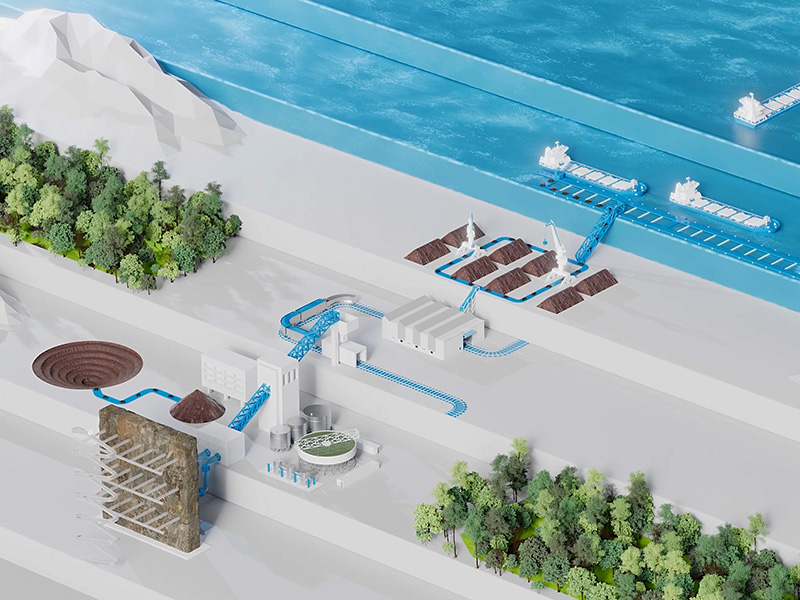

Underground mines are generally capital-intensive assets. Operating lives of 40+ years are not uncommon, and the vast amount of fixed infrastructure these mines require upfront, particularly for bulk extraction methods like block and panel caving, means that once built it can be difficult and costly to make changes to the mine plan or operating methodology.

Once a mine design is locked in, the aim is to schedule the development out in the most effective and productive way given the business’ evolving priorities and limitations. Traditionally, companies have relied on the experience and skillsets of their engineers to create effective schedules using information from CAD-based mine design programmes. And, until recently, the results have been good enough.

However, times are changing. Mines are getting deeper and riskier as operators chase orebodies through rock masses of increasing depth and geotechnical complexity. Mining methods are being challenged. Profit margins are getting tighter as ore grades decline. And both mining and ground support strategies are being adapted to keep pace with production demand as well as the integration of new technologies, such as battery-electric and autonomous fleets.

In the new environmentally, socially and governance (ESG) conscious norm, companies must also assess the impact of strategic decisions across their value chains. A miner’s choice of material handling method, for example, when developing a new area within an underground mine will affect the scope 3 emissions profile of its customers.

Set against a backdrop of fast-moving markets and a major talent shortage, these factors mean that today, agility is the name of the game in long-term mine planning. Going forward, companies that can’t pivot their operations quickly to take advantage of new technologies, higher metal prices or customer requests are the ones least likely to thrive. Likewise, as the 2020 COVID-19 pandemic proved, the ability to adapt to unforeseen circumstances is vital for every business.

Ben Hollis, Partner and Co-founder of Polymathian Industrial Mathematics, which is now a Deswik company following its acquisition by Sandvik in early 2023, explained: “Long-term strategic decisions usually entail a significant amount of capital. Take the example of a large stoping mine; the stopes have different values over time depending upon their mineralogy and accessibility.

“There is a constant trade off around how much the mine invests in development to access new areas of the orebody while still maximising the operation’s net present value (NPV). This tradeoff is also affected by the broader economic environment, and the profile of the company and its assets. It can be very hard to make optimal decisions.”

Going from good to best decisions

At an asset level, the goal of long-term planning is usually to create a smooth production profile where the mine delivers as much value over time as possible, as early as possible. But, given the complexities discussed, it can be difficult for humans to manually process the thousands of data points, constraints and scenarios involved at a speed that allows timely decisions to be made. And it’s almost impossible to find, not just an acceptable outcome, but an optimal one.

While the use of digital optimisation tools in certain mine functions is growing, they are still an underused resource in strategic mine planning. Yet the potential these software programs hold to support and improve decision making in complex systems is massive.

Hollis said: “The more complex the problem and the greater the number of options and constraints, the harder it is for people to weigh up different strategic decisions and their impacts over the life of mine. This is where we at Polymathian really excel.”

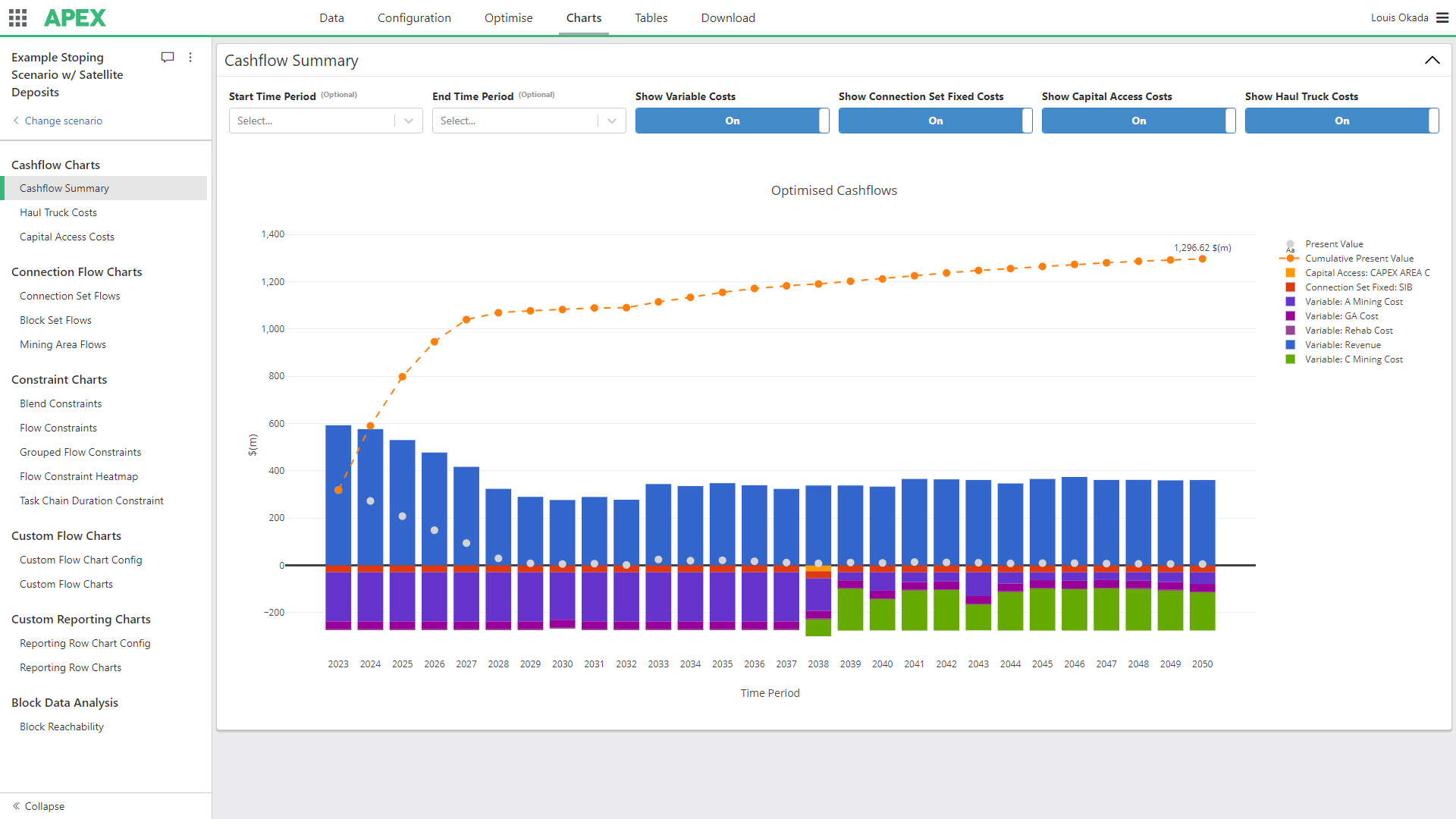

Polymathian has helped one of the world’s largest stoping mines to optimise its long-term planning. The mine has over 80,000 individual tasks that need to be scheduled over a 40+ year life and hundreds of constraints that plans need to conform to. Polymathian deployed its APEX cloud-based optimisation toolkit to solve the problem and was able to increase the mine’s NPV by 30% compared to the solutions offered by its incumbent software.

Screenshot of APEX showing a summary of cashflow for the life of the mine

“Some mine design software packages have a built-in scheduling algorithm that allows mines to find answers to specific problems,” Hollis said. “But the quality of the schedule is driven by the knowledge of the engineer who’s creating it. While the actual process of creating the schedule is automated, the decision-making parts of it are still manual. Sometimes that generates a good enough schedule, but what we’re interested in is finding the best possible schedule.”

Using dedicated mathematical optimisation tools, the user can define the problem and the desired outcome as well as the business’ overarching goals. The system will then find the best possible schedule over the specified time horizon, and this can be fed back into the mine design package. This process sometimes reveals options that a human wouldn’t have considered given their training and experience.

“Often today, there's a lot of value that's being left on the table,” said Hollis. “It can be hard to quantify that value and decide a) whether it’s worth going after, and b) whether it’s physically possible given the mine design. There can be so much variability and optionality in how mines sequence their tasks and it’s really important to get it right.”

Louis Okada, Head of Marketing and Sales at Polymathian, pointed out: “Mathematical optimisation is not a silver bullet, but it can provide a scientific basis for decision making. That’s vital today given rising operating costs, how scarce experienced engineers are and the growing complexity of underground operations.”

‘Seeing’ into the future

Simulation can also add value in strategic planning, albeit in a slightly different way.

For example, if a key area of a mine is expected to see heavy usage it could become a potential bottleneck. Discrete event simulation can be used to test assumptions about how the area will operate before the mine is built, or before a change to the mine plan is made. This allows the operator to tweak the design or operating methodology to avoid decisions that could prove costly or difficult in the future.

“If we take the example of a block cave,” Hollis said. “Once that design is locked in, there’s not much potential for flexibility in the operating method. It costs billions of dollars to develop the mine footprint, so how that footprint is operated is super important. If the operator can boost productivity by even a couple of percentage points, that will add up over 10 or 15 years."

“We’ve used discrete event simulation to validate (or invalidate) assumptions around productivity for block caves that were based on Excel formulas from their prefeasibility studies. Sometimes those assumptions fall apart when congestion and downtime are added into the mix.”

The same applies for expansions where a new mining area might use a different design layout or equipment to the rest of the operation. Simulation could test how these changes would impact the mine holistically prior to development, allowing the operator to resolve any issues proactively rather than reactively.

Both simulation and optimisation can also help with decisions around cutoff grades or to improve a project’s NPV by introducing variable cutoff grades for different scheduling periods, as applicable in a high-grading scenario.

Planning for the unexpected

Another area of strategic decision making in which simulation can prove useful is planning for uncertainty. For example, a mine could use optimisation tools to create a long-term plan, but some of the constraints used may entail a degree of uncertainty. This could be a continuous uncertainty, such as fluctuation in the mill throughput capacity, or a discrete event, such as the breakdown of a key piece of infrastructure.

Stochastic mine planning takes into account and generates models that describe uncertainty in the orebody as well as in the operating environment and markets. By adding stochasticity or randomness into the modelling process and playing that out through various simulations, mines can assess which solutions or long-term plans might work best given the probability of X,Y or Z happening.

This allows management teams who may not come from a technical background to make informed and quantifiable decisions based on the probability of achieving a specific target. It builds an extra layer of resilience into long-term planning and decision making, which is incredibly valuable at a time when there is so much volatility in the world.

Adding value in more ways than one

The beauty of Polymathian’s solutions is that they are vendor agnostic and can integrate seamlessly with the design tools a mine currently has; they complement rather than replace them, thus avoiding any costly change management issues.

Hollis said: “Value-add optimisation and simulation for scheduling isn’t new, but we’re seeing more and more mines looking to deploy these tools for strategic decision making in order to circumvent skills shortages and free up time for key personnel.”

Because they can run hundreds of simulations or optimisations relatively quickly, these tools allow mines to get more creative with their long-term planning. For instance, rather than just optimising an operation from an NPV perspective, there may be other commercial levers that businesses could harness, such as targeting different minerals within a deposit, stockpile or waste dump to create a secondary value stream. The possibilities are endless…

Okada added: “In the US, the Inflation Reduction Act has empowered a lot of mining companies to revisit their long-term plans to take advantage of certain tax credits or incentives which change the economics around how they mine the deposit. Some countries now have critical minerals lists which allow certain operators to expedite their mining licenses.

“The landscape is changing fast and using simulation and mathematical optimisation will allow companies to react quickly and become more dynamic, which will ultimately give them a competitive advantage.”